ULT growth fund enhancing wildlife & habitat health – in perpetuity

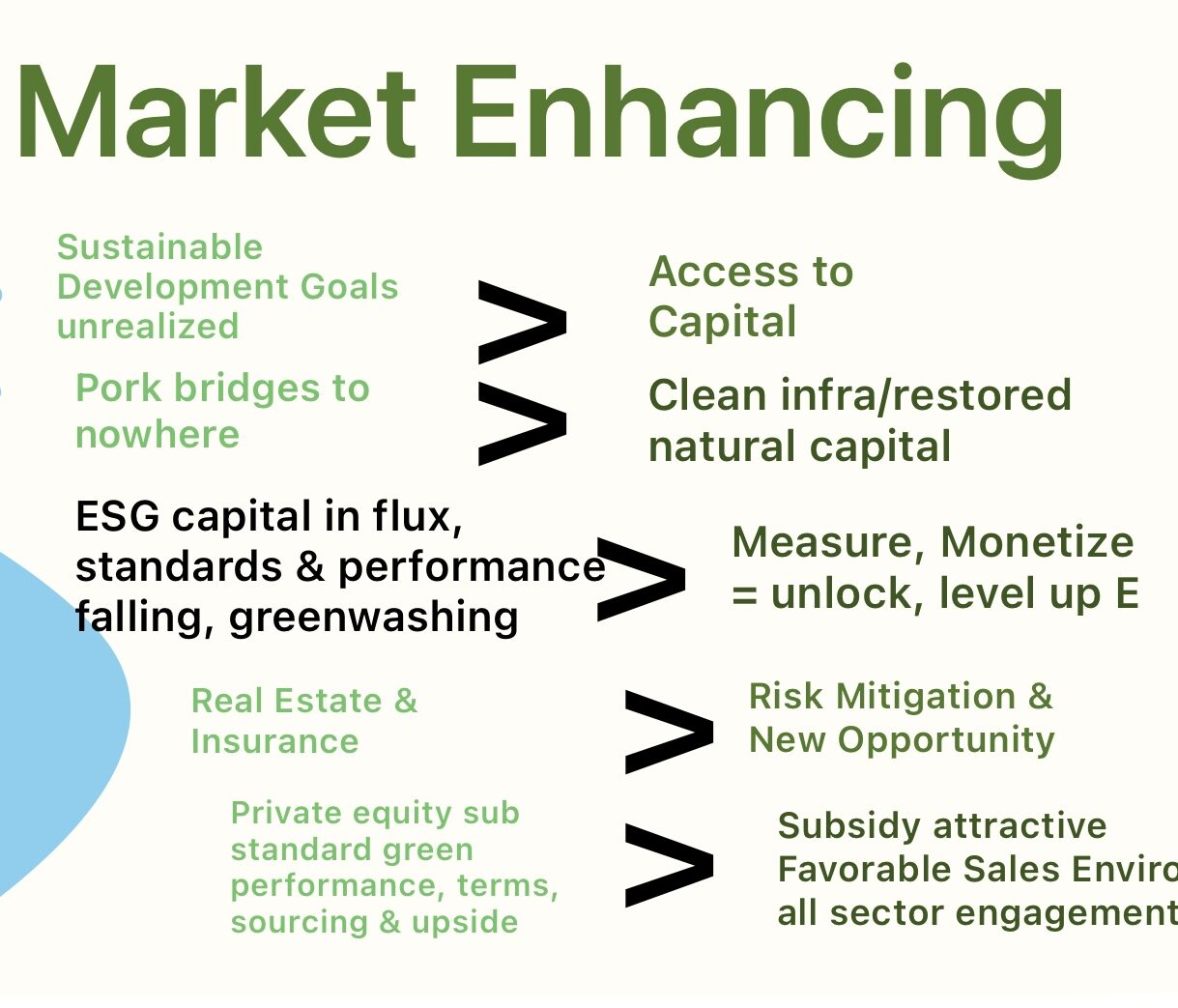

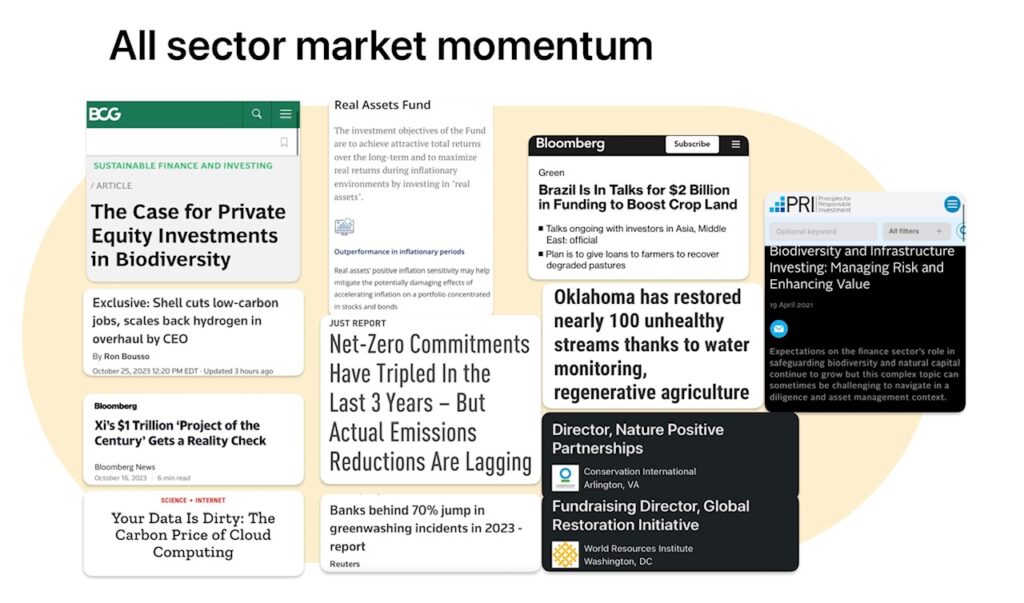

State of Play: Market conditions rife with inefficiency, and drag, from the push and pull of short term objectives (extractive) vs. long term objectives (renewable)

Gold standard Green bond backed Equity, Debt & Credit

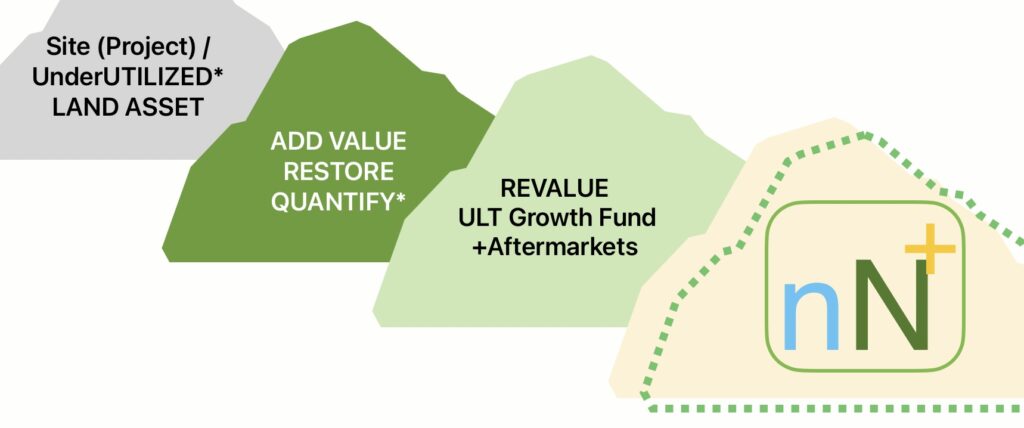

Renewable infrastructure projects and/or Under-Utilized land

Aligned Excellence in Environmental sustainability Ecology enhancement, Natural Infrastructure, Nature based Solutions

Access to Finance for game-changing sustainability-focused public/private infrastructure projects & Corps, wiring-in habitat & climate restoration, putting to work underutilized land.

Business Goal Deliver +20% ultra long term investor returns on the Fund, its Capital & Trust + R&D: innovative partnerships drive new vehicles that revalue natural capital in markets

MIssion-Built driving all-scale habitat renewal and conservation

~ Conservation financing

Impact Model Circular for-benefit % of proceeds create sustaining structures <> sustaining structures achieve impact mission

Trust Real estate & Ecology partners land-buy in concert with Public Subsidy, re-utilize, restore, monetize & preserve

Community Habitat Renewal Endowment finance small-scale renewal; co-hosted by nature NGO’s

Foundation Advisors board & Ecology partners Quantify natures benefits, redefine Utilization & monitor Fund impact

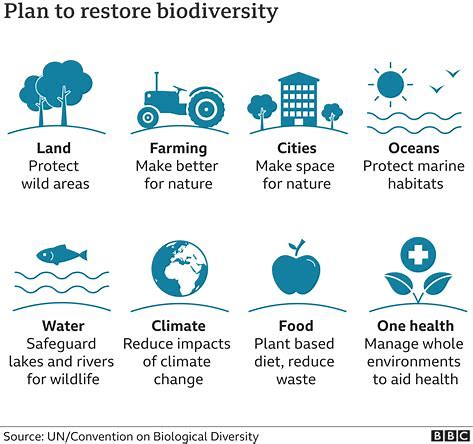

Objective Restore wildlife & habitats, strengthen local resilience, enhance biodiversity, mobilize communities around wildlife & sustainability

Net Nature + Portfolio strategy INVESTS IN reforestation frontiers, nature as infrastructure solutions, prairie restoration, carbon sink strategies, enhancing local biodiversity, climate mitigation and resilience, providing rural communities with sustaining equity through renewable infrastructure nature based solutions and financing conservation through all-scale habitat renewal WHILE offering excellent return on capital ALONG WITH revenue growth and diversity via: syndication, aftermarkets, market maker positions in land value and protective credits; ecology engineering and agro-forestry services; structured finance 4 nature product development…

WHY DO THIS

There is no business without nature

Bridge Gaps, crisis into opportunity

Nature is the Solution: ROOTS of Business Model

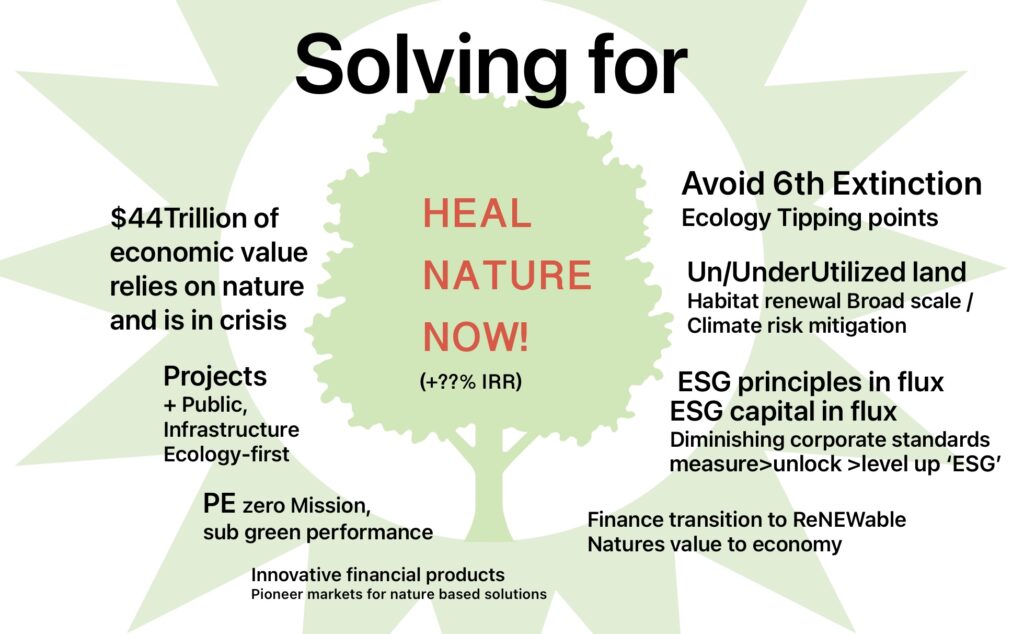

The deterioration of our natural capital is a severely under-invested area. This is having a dramatic and catalytic impact on food, livelihoods, climate and biodiversity.

Increased private finance can accelerate habitat restoration globally

Global pull factors needed to promote restoration

The lack of finance is one of the key barriers to up-scaling restoration to meet global targets. Most finance for restoration currently comes from public budgets but these funds are too limited to support restoration needs, and they compete with a wide array of other public commitments. Since private actors have a strong influence over landscape changes through their investment decisions they can potentially play a large role in complementing public-sector activities to enhance global restoration efforts. Nature Ecology & Evolution | May 2023

20 to 40% of all Earths land is/being degraded (Over 70% of the Earth’s entire land area has been transformed from its natural state)

More than half of the global GDP depends on natural resources.

To end nature loss by 2030 – in line with limiting global temperature rise to 1.5°C – requires $350 billion in finance per year by the end of the decade. Despite representing 30% of the climate solution, Nature-based Solutions receive just 3% of climate finance.

From Urgent Need > Market maker

“Land Degradation Neutrality” of the UN Sustainable Development Goals is unrealized and off track, requiring much more private capital, innovation and expertise.

Platform approaches, combining specialist research, project and asset sourcing in frontier markets with sophisticated financial and measurement capabilities, can spur rapid growth in natural capital investment.

World Economic Forum: natural climate solutions can provide one-third of the climate mitigation needed to reach the 2030 objectives, approximately 7 Gt of CO2 with an average price significantly lower than other CO2 removal solutions.

The voluntary carbon market and credits, those generated by natural climate solutions, is maturing, with a projected size of $50 billion by 2030

As a Public Private Catalytic fund, growing opportunities to lever AUM to drive ecological impact/ natural climate solutions globally:

LEAF Coalition $1B in financing for tropical forests in emerging markets; HSBC Pollination Climate Asset Management; Mirova’s Land Degradation Neutrality Fund; Althelia Sustainable Ocean Fund and Biodiversity Fund Brazil; WWF and South Pole’s Landscape Resilience Fund; Acumen’s Resilient Agriculture Fund.